Simplify Compliance with the

2026 Payroll & HR Cheat Sheet for Hawaii Employers

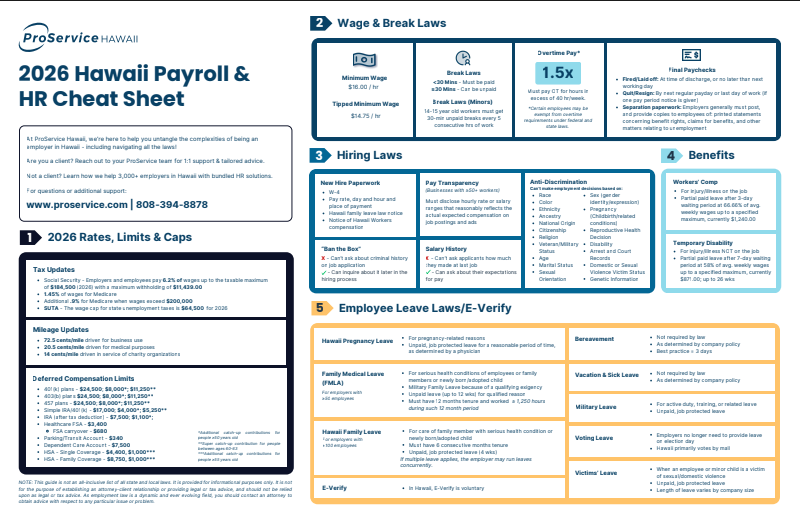

From pay rates and overtime rules to leave laws and required notices, 2026 brings important updates for Hawaii employers. This free cheat sheet breaks it all down in one easy reference — so you can focus on running your business with confidence.

Hawaii’s Minimum Wage Has Changed. Are You Ready for 2026?

The 2026 Payroll & HR Cheat Sheet helps Hawaii employers stay compliant with the new minimum wage — plus other key payroll, tax, and employment law updates you need to know this year.

Get the Cheat Sheet

What's inside:

2026 Minimum Wage & Overtime Rules: Current Hawaii minimum wage rates, tipped wage details, and overtime requirements

Payroll Tax Rates, Limits & Caps: Social Security, Medicare, SUTA, and other key payroll thresholds for 2026

Wage, Break & Final Paycheck Laws: What employers must know about breaks, minors, and employee separations

Hiring & Pay Transparency Rules: Pay disclosure requirements, salary history bans, and “Ban the Box” guidance

Employee Leave Laws & E-Verify: Hawaii Family Leave, FMLA, pregnancy leave, military leave, and more

Trusted by Over 3,000 Local Employers

Since 1994, ProService Hawaii is the leading provider of bundled HR solutions that empower employers to succeed in Hawaii. We help employers with HR strategy, payroll, benefits, risk and compliance management, and much more. Find out what we can do for you.